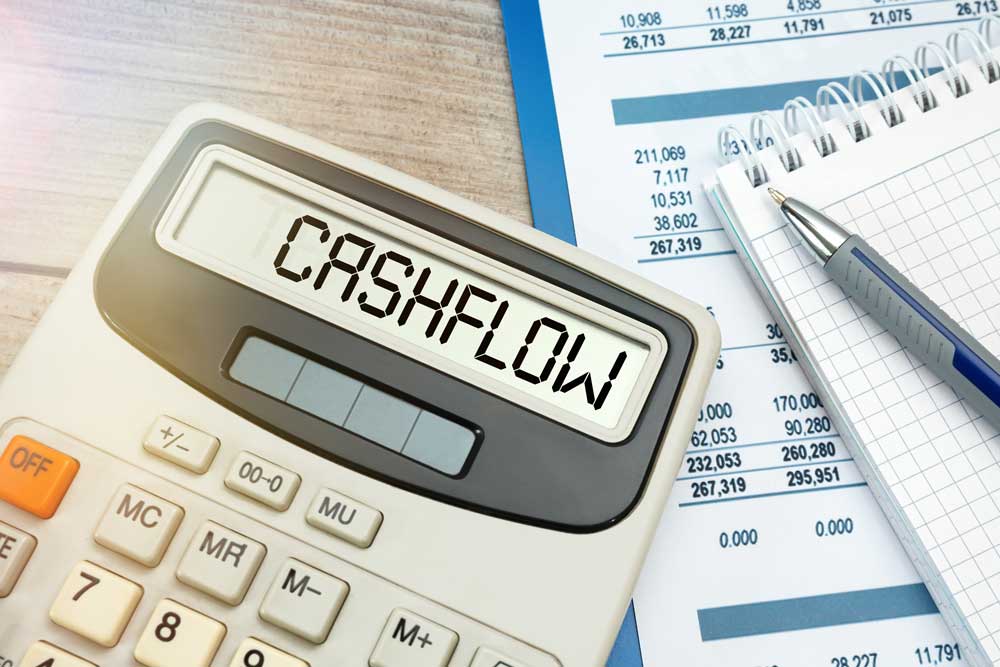

Importance of Personal Finance Management

In today’s world, money is an essential part of our life. In a way, we can say that money is the life blood that lets us live a comfortable life. True, money can’t buy us happiness, but it certainly gives us the assurance of a secured future and freedom to purchase things which make us and our loved ones happy.

In today’s world, money is an essential part of our life. In a way, we can say that money is the life blood that lets us live a comfortable life. True, money can’t buy us happiness, but it certainly gives us the assurance of a secured future and freedom to purchase things which make us and our loved ones happy.

But despite all this, most people are either too careless about managing their personal finances or just don’t know how to do it efficiently. As a result, most people start caring about their money only when they have left with very less of it. In the 21st century world, it has almost become a norm.

The so-called double income families love to a life of every luxury possible in the world and they don’t even think twice before digging into their savings or taking loans to get it. As a result, 8 out of 10 people have at least some loans on their head.

Until two years ago, the effects of bad personal finance management was only seen on a small level. But the current recession has turned the demon of badly managed personal finance into a national calamity.

The failing banks, closing businesses and cost cuttings left a large number of people without a job.

But the unemployment was just a push to create a whole domino effect on the economy. Devoid of any personal savings and buried under loans, people started losing their homes, cars and even health insurance. So many people defaulted on their insurance payment that many insurance companies declared bankruptcy and many others were on the brink of going out of business.

We can blame so many factors for this – the government, the corporates and most of all the banks who gave easy loans to people who could never afford them. But the truth is that it’s the job of banks to encourage us to take loans. That’s how their business. It’s only up to us to make complete sense of the situation.

Your banker would love to get you the huge loan for your second luxury car or a holiday home because he will benefit from it. He will even convince you that you are making the wisest decision by making a bigger purchase than you could ever afford to.

But you must understand that managing personal finances is extremely important. Make sure that you don’t make any purchase that’s out of your reach. We are not suggesting that you don’t take loan, but take it only when and only as much as essential. Try to create a savings account and keep an equivalent of three months of expenses in it, at all times.

In the end, I would say that bad times come in everybody’s life. We all have to go through our shares of difficulties whether its unemployment, sickness, or injury. All we can do is to make sure that we are prepared for it (at least financially).