Find the best home financing options with our Key Resources for Home Financing in Philadelphia. Learn about loan types, lenders, and more.

Find the best home financing options with our Key Resources for Home Financing in Philadelphia. Learn about loan types, lenders, and more.

Exploring the Different Types of Home Financing Options Available in Philadelphia

Philadelphia is a great place to call home, and there are many different types of home financing options available to those looking to purchase a home in the city. Whether you are a first-time homebuyer or an experienced homeowner, it is important to understand the different types of home financing options available in Philadelphia.

The most common type of home financing is a traditional mortgage. This type of loan is typically secured by the home itself and is offered by banks, credit unions, and other lenders. Traditional mortgages typically require a down payment of at least 20% of the purchase price of the home, and the interest rate is usually fixed.

How to Find the Best Home Financing Rates in Philadelphia

Finding the best Key Resources for Home Financing in Philadelphia can be a daunting task. With so many lenders and loan products available, it can be difficult to know where to start. However, by following a few simple steps, you can find the best home financing rates in Philadelphia.

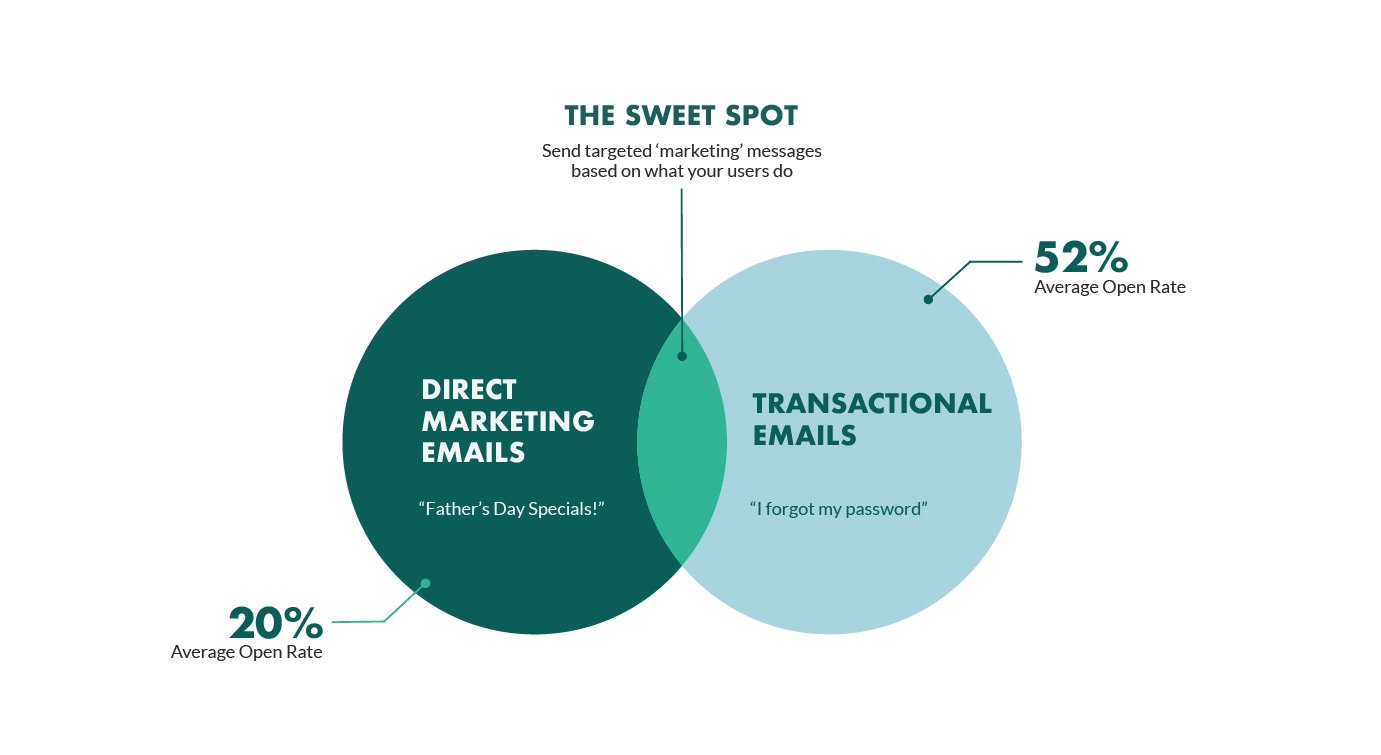

First, it is important to understand the different types of home financing available. There are two main types of home financing: fixed-rate mortgages and adjustable-rate mortgages. Fixed-rate mortgages have a set interest rate that remains the same throughout the life of the loan. Adjustable-rate mortgages, on the other hand, have an interest rate that can change over time.

Understanding the Benefits of Working with a Local Home Financing Expert in Philadelphia

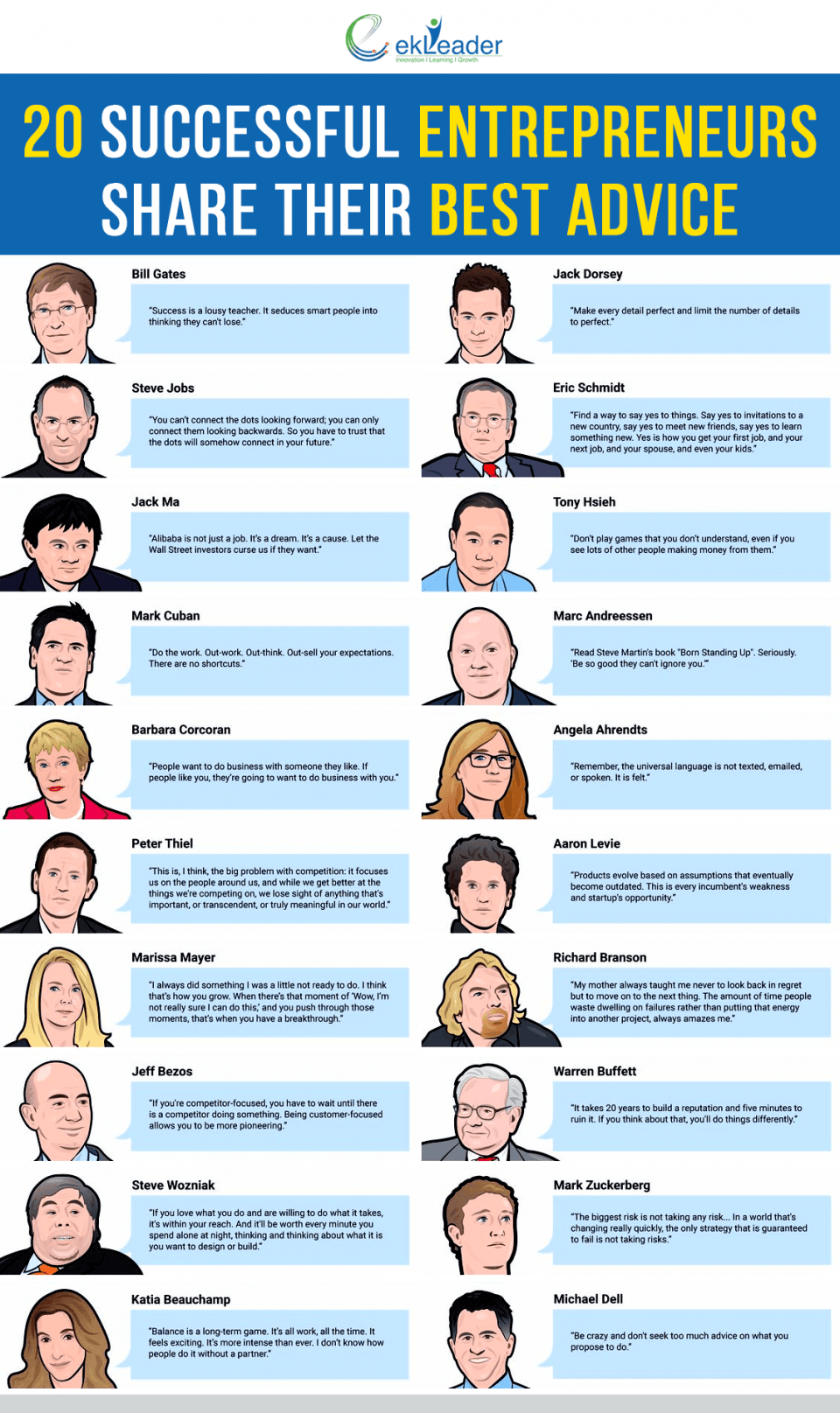

When it comes to financing a home in Philadelphia, working with a local home financing expert can be a great way to ensure that you get the best possible deal. A local home financing expert can provide you with a wealth of knowledge and experience that can help you make the most informed decision when it comes to financing your home. Here are some of the benefits of working with a local home financing expert in Philadelphia.

1. Knowledge of the Local Market: A local home financing expert in Philadelphia will have a deep understanding of the local real estate market. This knowledge can be invaluable when it comes to finding the best loan terms and rates for your particular situation. A local expert will be able to provide you with insight into the current market conditions.