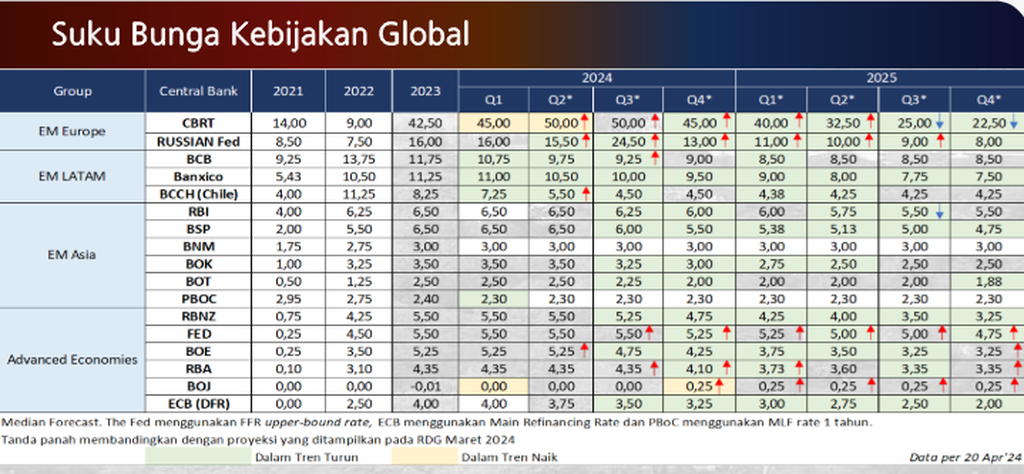

The Fed’s May 2025 Meeting: A Recap of the Economic Landscape

By May 2025, the US economy was navigating a complex landscape. Inflation, while significantly cooled from its peak in late 2023, still lingered above the Federal Reserve’s 2% target. The unemployment rate had remained stubbornly low, hovering around 3.5%, suggesting a tight labor market. Growth, while positive, had slowed, hinting at a potential economic slowdown or even a mild recession. Geopolitical uncertainties, particularly surrounding energy markets and global trade, further complicated the outlook. This mixed bag of economic indicators presented the Fed with a difficult challenge in determining its next course of action regarding interest rates.

Inflation Remains a Key Concern, Despite Progress

Despite significant progress in taming inflation, the Fed remained cautious. While the headline inflation numbers showed a decline, core inflation – which excludes volatile food and energy prices – remained persistently elevated. This suggested that underlying inflationary pressures had not completely dissipated. The Fed worried that prematurely loosening monetary policy could reignite inflation, undoing the hard-won gains of the previous two years. The persistence of core inflation fueled discussions within the Federal Open Market Committee (FOMC) regarding the appropriate pace of future interest rate adjustments.

The Employment Picture: A Double-Edged Sword

The persistently low unemployment rate presented a dilemma. While a strong labor market is generally positive, it can contribute to upward pressure on wages, further fueling inflation. The Fed carefully weighed the benefits of full employment against the risks of accelerating inflation. The ongoing tightness in the labor market, combined with robust consumer spending, indicated a strong economy, but also one prone to overheating if not carefully managed through monetary policy. This nuanced understanding of the employment situation informed the FOMC’s deliberation.

Global Economic Headwinds and Their Influence on the Fed’s Decision

The global economic environment significantly influenced the Fed’s decision-making. Slowdowns in major economies, ongoing geopolitical tensions, and supply chain disruptions posed external risks to the US economy. The Fed needed to consider how these external factors could impact domestic inflation and growth. The interconnected nature of the global economy meant that the Fed couldn’t operate in a vacuum, requiring a careful consideration of international economic conditions when setting monetary policy. A global recession, for instance, could quickly dampen US economic growth, impacting inflation and employment trends.

The FOMC’s May 2025 Decision on Interest Rates

After careful deliberation, the FOMC decided to maintain the federal funds rate at 5.25%. This decision reflected a cautious approach, acknowledging the progress made in reducing inflation but also recognizing the lingering risks. The statement accompanying the decision highlighted the FOMC’s commitment to price stability and its assessment of the evolving economic situation. While the rate remained unchanged in May, the statement hinted at the possibility of future rate adjustments depending on incoming economic data. The Fed’s communication emphasized a data-dependent approach, suggesting that future decisions would be contingent on the trajectory of inflation, employment, and other key economic indicators.

Market Reaction and Subsequent Economic Developments

The market reacted relatively calmly to the Fed’s decision. The holding of the interest rate at 5.25% was largely in line with market expectations, indicating a level of confidence in the Fed’s approach. However, investors continued to closely monitor upcoming economic data releases, particularly inflation figures, for clues about the future direction of monetary policy. In the months following the May meeting, the economy continued to show mixed signals. Inflation showed further modest declines, but the persistent tightness in the labor market and some signs of renewed consumer spending kept the Fed’s vigilance high. The precise trajectory of interest rates in the subsequent months depended heavily on the unfolding economic landscape and the Fed’s ongoing assessment of risks and rewards.

Forward Guidance and the Path Ahead

The Fed’s forward guidance in May 2025 emphasized flexibility and a data-dependent approach. The FOMC signaled that it would carefully monitor incoming economic data and adjust its monetary policy stance as needed. This highlighted the uncertainty surrounding the economic outlook and the Fed’s commitment to adapt its strategy in response to evolving conditions. The path ahead remained uncertain, but the Fed’s focus on price stability and its commitment to flexible policy-making provided some reassurance to the markets and the broader economy. Click here for information about the Federal Reserve’s interest rate policy in May 2025.

:max_bytes(150000):strip_icc()/GettyImages-2207856637-1bec9a7506d543f7a8eaf38a8bdb4a30.jpg)