Mastering the Fundamentals

Embarking on the entrepreneurial journey is exhilarating yet fraught with financial challenges. To navigate these waters successfully, entrepreneurs must first grasp the fundamentals of financial management. This includes understanding cash flow, budgeting, and financial forecasting. By laying a solid foundation in financial literacy, entrepreneurs can make informed decisions that drive business growth and sustainability.

Strategic Investment Allocation

One of the hallmarks of effective financial management for entrepreneurs is strategic investment allocation. This entails judiciously allocating resources across various facets of the business, from marketing and technology to talent acquisition and infrastructure. By prioritizing investments based on their potential for long-term returns, entrepreneurs can optimize resource utilization and maximize profitability.

Risk Management and Contingency Planning

Entrepreneurship inherently involves risk, but savvy entrepreneurs mitigate these risks through proactive risk management and contingency planning. This entails identifying potential threats to the business, whether they be market fluctuations, regulatory changes, or unforeseen crises, and developing strategies to address them. Diversifying revenue streams, maintaining adequate insurance coverage, and establishing emergency funds are essential components of effective risk management.

Leveraging Financial Tools and Technology

In today’s digital age, entrepreneurs have access to a myriad of financial tools and technologies that can streamline operations and enhance decision-making. From cloud-based accounting software to digital payment platforms and analytics tools, leveraging these resources can provide invaluable insights into the financial health of the business. Furthermore, automation can help reduce manual errors and free up time for strategic planning and innovation.

Building Strong Relationships with Financial Partners

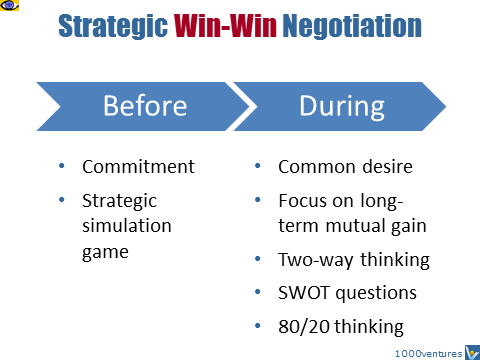

Establishing strong relationships with financial partners, whether they be investors, lenders, or strategic partners, is crucial for entrepreneurial success. These relationships can provide access to capital, expertise, and valuable networking opportunities that can propel the business forward. However, it’s essential to approach these partnerships with transparency, integrity, and a clear understanding of mutual expectations.

Continuous Learning and Adaptation

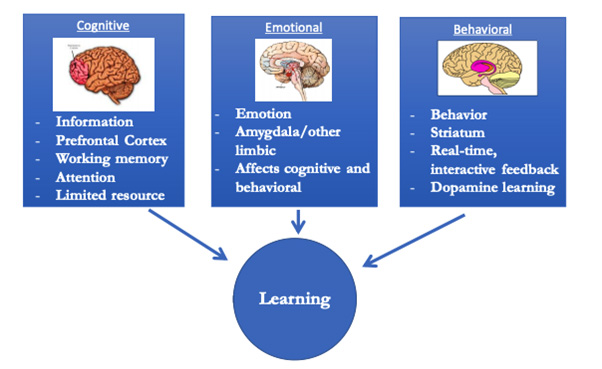

The financial landscape is constantly evolving, and successful entrepreneurs recognize the importance of continuous learning and adaptation. Staying abreast of industry trends, regulatory changes, and emerging technologies can provide a competitive edge and help entrepreneurs make informed financial decisions. Additionally, remaining agile and adaptable allows entrepreneurs to pivot in response to changing market conditions and seize new opportunities for growth.

Embracing Frugality and Resourcefulness

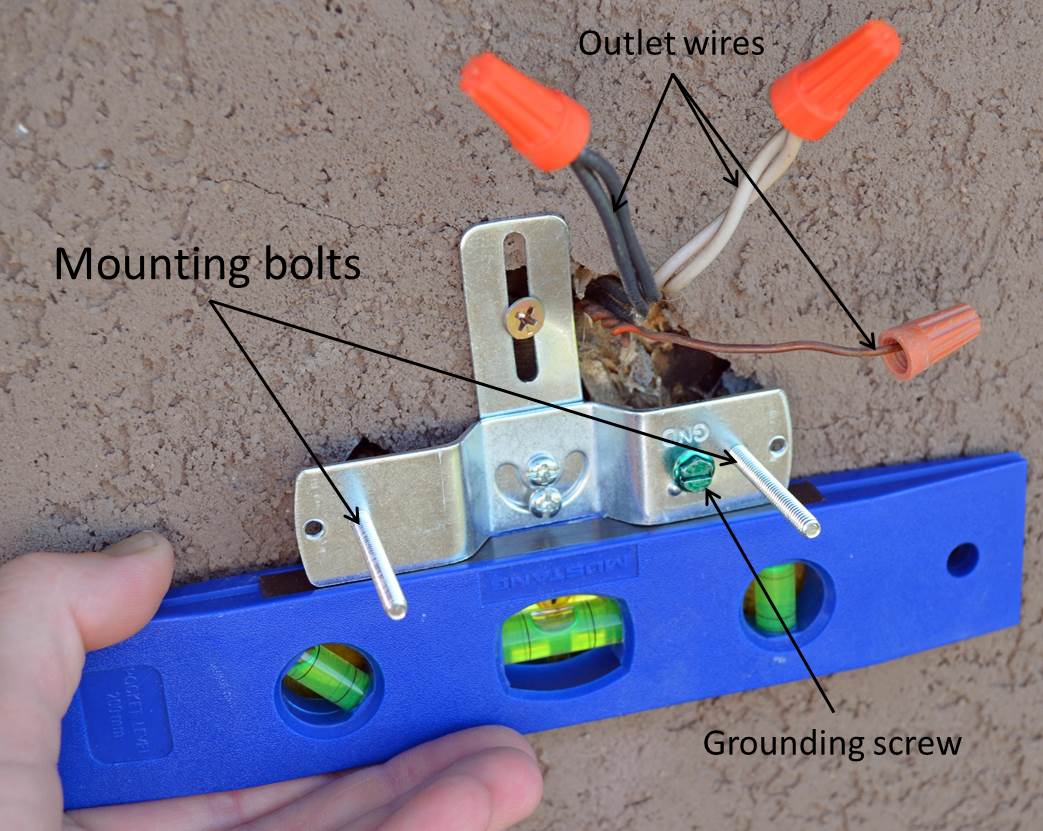

While financial resources are essential for entrepreneurship, frugality and resourcefulness can be equally valuable traits. Adopting a lean mindset encourages entrepreneurs to optimize resource allocation, minimize unnecessary expenses, and maximize efficiency. Whether it’s negotiating better deals with suppliers, embracing DIY solutions, or creatively bootstrapping growth, a resourceful approach to financial management can yield significant dividends.

Seeking Mentorship and Guidance

Navigating the complexities of entrepreneurial finance can be daunting, but entrepreneurs don’t have to go it alone. Seeking mentorship and guidance from experienced professionals can provide invaluable insights and perspective. Whether through formal mentorship programs, networking events, or industry associations, connecting with seasoned entrepreneurs and financial experts can help entrepreneurs avoid common pitfalls and accelerate their path to success.

Cultivating a Long-Term Financial Mindset

Successful entrepreneurship is not just about short-term gains but also about cultivating a long-term financial mindset. This entails setting clear financial goals, developing a strategic roadmap for achieving them, and exercising discipline and patience along the way. By focusing on sustainable growth and value creation, entrepreneurs can build resilient businesses that stand the test of time.

Conclusion

In conclusion, financial advice for entrepreneurs encompasses a multifaceted approach that spans mastering the fundamentals, strategic investment allocation, risk management, leveraging technology, building strong relationships, continuous learning, embracing frugality, seeking mentorship, and cultivating a long-term mindset. By adopting these principles and practices, entrepreneurs can navigate the financial complexities of entrepreneurship with confidence and achieve lasting success.