What are Tokenized Assets?

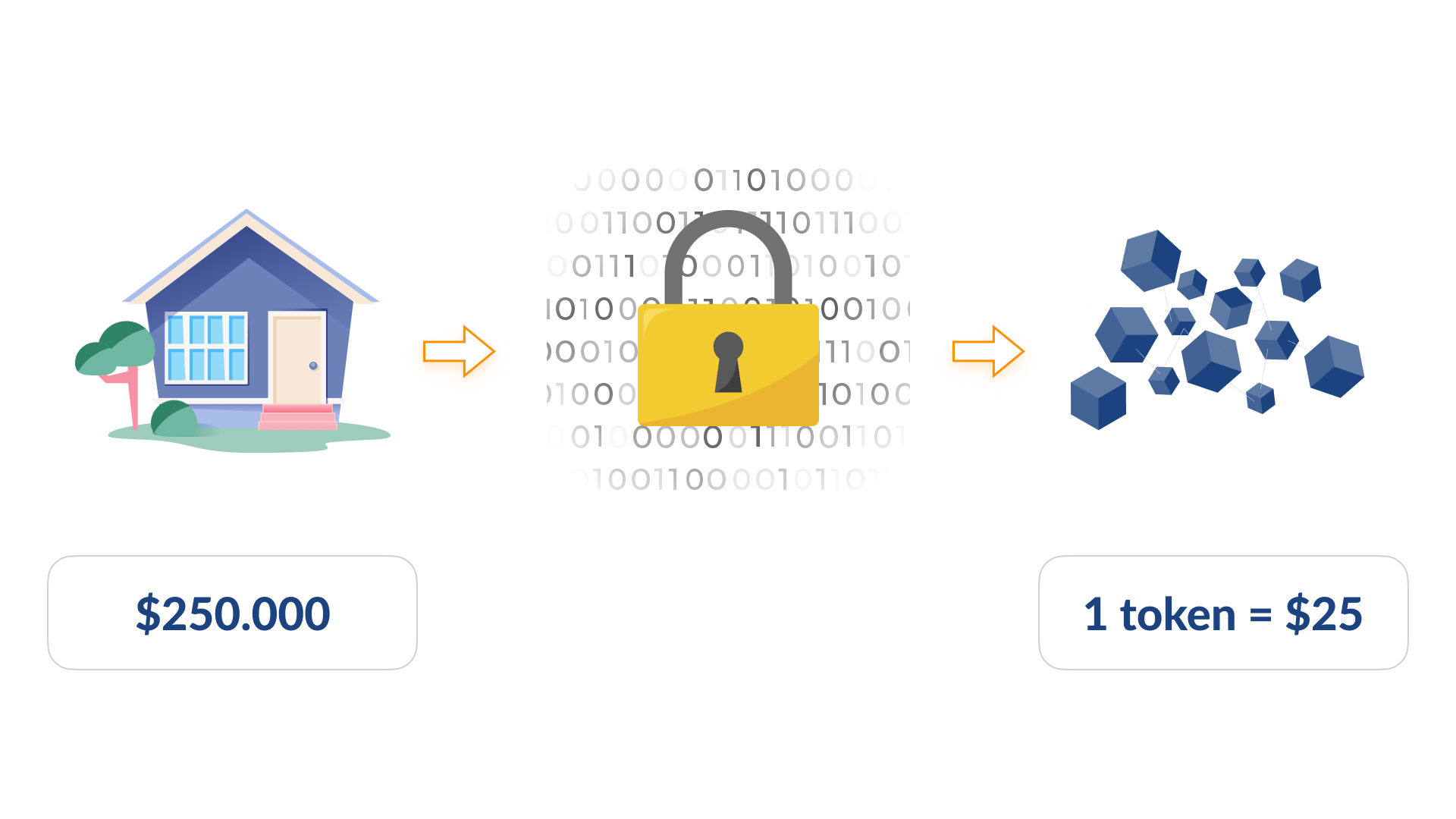

Imagine owning a fraction of a valuable painting, a rare collectible card, or even real estate, all without the complexities of traditional ownership. That’s the promise of tokenized assets. These are assets, whether physical or digital, that have been converted into digital tokens on a blockchain. This process allows for fractional ownership, making previously inaccessible investments more readily available to a wider range of people. Think of it as slicing up a pie and distributing those slices digitally, each slice represented by a unique token that proves ownership.

The Technology Behind Tokenization

The magic behind tokenization lies in blockchain technology. A distributed ledger system, the blockchain securely records every transaction involving the token, ensuring transparency and immutability. Different blockchain networks, like Ethereum or Solana, can be used, each with its own advantages and disadvantages in terms of speed, scalability, and transaction fees. Smart contracts, self-executing contracts written in code, are often employed to automate processes like dividend payments or the transfer of ownership, enhancing efficiency and reducing the need for intermediaries.

Benefits of Tokenized Assets for Investors

For investors, tokenized assets offer several compelling benefits. Firstly, fractional ownership dramatically lowers the barrier to entry for high-value assets. Instead of needing millions to buy a whole painting, investors can purchase a small fraction, diversifying their portfolios more effectively. Secondly, the liquidity of tokenized assets is often significantly improved compared to traditional assets. Tokens can be traded easily and quickly on decentralized exchanges, making it simpler to buy and sell. Finally, the transparency offered by the blockchain eliminates many of the uncertainties associated with traditional asset ownership.

Benefits for Asset Owners

The advantages extend beyond investors. For those owning assets like real estate or art, tokenization can open up new avenues for raising capital. By tokenizing their asset, they can sell fractional ownership, unlocking liquidity without needing to sell the entire asset. This can be especially beneficial in situations where immediate liquidity is needed but selling the entire asset isn’t desirable. Tokenization also simplifies the process of managing ownership and distributing profits or dividends.

Challenges and Risks Associated with Tokenized Assets

Despite the potential, tokenized assets aren’t without challenges. Regulatory uncertainty is a significant hurdle, as the legal frameworks surrounding digital assets are still evolving in many jurisdictions. The volatility of cryptocurrency markets can impact the value of tokenized assets, even if the underlying asset itself is stable. Security risks, such as hacks or exploits on the blockchain, are also a concern, though blockchain technology is generally considered secure.

The Future of Tokenized Assets: Expanding Possibilities

The future of tokenized assets looks promising. As the technology matures and regulatory clarity emerges, we can expect to see wider adoption across a broader range of asset classes. Beyond art and real estate, tokenization could revolutionize ownership in areas like intellectual property, collectibles, and even commodities. The potential for increased efficiency, transparency, and accessibility makes tokenization a transformative technology with the power to reshape the landscape of asset ownership.

Real-World Examples of Tokenized Assets

Several real-world examples already showcase the potential of tokenized assets. Companies are tokenizing shares of their businesses, allowing for easier fundraising and wider investor participation. Luxury goods brands are exploring tokenization to enhance the authenticity and traceability of their products. Real estate developers are offering fractional ownership of properties through tokenized investments, opening up real estate markets to a broader investor base. These early successes demonstrate the growing traction of tokenized assets and suggest a bright future for this innovative technology.

The Role of Decentralized Autonomous Organizations (DAOs)

Decentralized Autonomous Organizations (DAOs) are playing an increasingly significant role in the tokenized asset ecosystem. DAOs are community-governed entities that utilize smart contracts to automate decision-making and manage assets. They are frequently used to manage tokenized assets, offering a transparent and democratic approach to ownership and governance. The emergence of DAOs further highlights the decentralized and democratic potential of tokenized assets. Please click here to learn about tokenized assets.