Maneuvering Taxation: Expert Advice for New Business Owners

Taxation is an integral aspect of business ownership, and navigating the complexities of taxes can be overwhelming for new entrepreneurs. Here are some essential tips to help new business owners manage their tax obligations effectively:

Understand Your Tax Obligations

As a new business owner, it’s crucial to understand your tax obligations from the outset. Familiarize yourself with the different types of taxes that may apply to your business, including income tax, self-employment tax, sales tax, and payroll tax. Know when your tax filings are due and what records you need to maintain for accurate reporting.

Keep Detailed Financial Records

Maintaining accurate and detailed financial records is essential for effective tax management. Keep track of all income, expenses, receipts, invoices, and other financial transactions related to your business. Use accounting software or hire a professional bookkeeper to ensure your records are organized and up to date. Keeping thorough financial records will not only simplify tax preparation but also help you identify opportunities for tax deductions and credits.

Separate Personal and Business Finances

To streamline tax reporting and ensure compliance with tax laws, it’s important to separate your personal and business finances. Open a separate bank account and credit card for your business transactions, and avoid commingling personal and business funds. This separation not only makes it easier to track business expenses but also provides clarity and transparency for tax purposes.

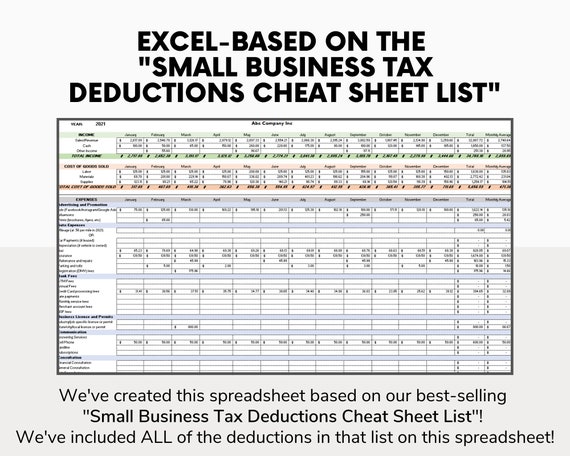

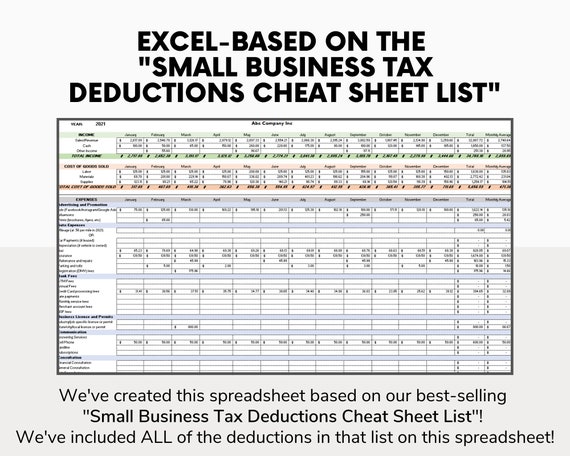

Take Advantage of Tax Deductions

As a business owner, you may be eligible for various tax deductions that can lower your taxable income and reduce your tax liability. Common deductions include business expenses such as rent, utilities, supplies, equipment, and professional services. Additionally, you may be able to deduct expenses related to travel, meals, entertainment, and home office use. Be sure to keep accurate records and consult with a tax professional to maximize your deductions while staying compliant with tax laws.

Consider Entity Structure

The legal structure of your business can have significant implications for taxation. Different entity structures, such as sole proprietorship, partnership, corporation, or limited liability company (LLC), have different tax treatment and requirements. Consider the tax implications of each structure and choose the one that best suits your business needs and goals. Consulting with a tax advisor or attorney can help you make an informed decision and minimize your tax burden.

Plan for Estimated Tax Payments

As a self-employed individual or business owner, you may be required to make estimated tax payments throughout the year to cover your tax liability. Estimate your annual tax obligation based on your income and deductions, and make quarterly payments to the IRS or state tax authorities. Failing to plan for estimated tax payments can result in penalties and interest charges, so be proactive in budgeting for these payments.

Stay Informed About Tax Law Changes

Tax laws and regulations are subject to change, so it’s important to stay informed about any updates that may affect your business. Subscribe to newsletters, attend seminars, or consult with a tax professional to stay up to date on relevant tax law changes. Being proactive in staying informed will help you adapt your tax strategy accordingly and ensure compliance with current regulations.

Seek Professional Guidance

Navigating the intricacies of business taxation can be challenging, especially for new entrepreneurs. Consider seeking guidance from a qualified tax professional or accountant who can provide expert advice tailored to your specific situation. A tax professional can help you identify tax-saving opportunities, optimize your tax strategy, and ensure compliance with tax laws and regulations. While hiring a tax professional may require an investment upfront, the potential savings and peace of mind they provide can outweigh the cost.

Plan Ahead for Success

Effective tax planning requires careful consideration and strategic foresight. As a new business owner, take the time to develop a comprehensive tax strategy that aligns with your business goals and objectives. Plan ahead for tax payments, maximize deductions, and stay proactive in managing your tax obligations throughout the year. By staying organized, informed, and proactive, you can minimize your tax burden and set yourself up for financial success as a new business owner.

Embrace New Business Owner Tax Tips

Starting a new business is an exciting venture, but it also comes with responsibilities, including tax obligations. By following these essential tips and leveraging the insights provided by new business owner tax tips, you can navigate the complexities of business taxation with confidence and efficiency. So, embrace these tips, stay proactive in managing your tax obligations, and pave the way for financial success as a new business owner.